Some Known Factual Statements About Hsmb Advisory Llc

Some Known Factual Statements About Hsmb Advisory Llc

Blog Article

The 20-Second Trick For Hsmb Advisory Llc

Table of ContentsHsmb Advisory Llc Fundamentals ExplainedExamine This Report about Hsmb Advisory LlcHsmb Advisory Llc Things To Know Before You BuySome Ideas on Hsmb Advisory Llc You Need To KnowNot known Details About Hsmb Advisory Llc Our Hsmb Advisory Llc Statements

Ford states to avoid "cash money value or irreversible" life insurance, which is even more of a financial investment than an insurance policy. "Those are extremely made complex, come with high commissions, and 9 out of 10 people do not require them. They're oversold since insurance representatives make the largest commissions on these," he says.

Impairment insurance coverage can be pricey. And for those that choose for long-term care insurance coverage, this plan may make handicap insurance policy unnecessary.

Hsmb Advisory Llc Can Be Fun For Everyone

If you have a persistent health concern, this kind of insurance coverage could end up being important (St Petersburg, FL Life Insurance). Nonetheless, do not allow it worry you or your checking account early in lifeit's usually best to take out a policy in your 50s or 60s with the expectancy that you won't be utilizing it until your 70s or later on.

If you're a small-business owner, consider protecting your source of income by acquiring company insurance coverage. In the event of a disaster-related closure or period of restoring, organization insurance coverage can cover your earnings loss. Take into consideration if a significant weather condition event impacted your store or production facilityhow would that influence your revenue?

Plus, making use of insurance coverage could sometimes set you back greater than it conserves over time. For instance, if you get a chip in your windscreen, you may take into consideration covering the repair expense with your emergency situation cost savings instead of your automobile insurance coverage. Why? Since utilizing your automobile insurance can trigger your regular monthly costs to go up.

Unknown Facts About Hsmb Advisory Llc

Share these tips to safeguard enjoyed ones from being both underinsured and overinsuredand talk to a relied on specialist when required. (https://www.provenexpert.com/hsmb-advisory-llc/)

Insurance coverage that is acquired by a private for single-person insurance coverage or protection of a family. The private pays the costs, instead of employer-based health and wellness insurance coverage where the employer often pays a share of the costs. Individuals might shop for and acquisition insurance from any kind of plans available in the person's geographic area.

People and families might qualify for financial help to decrease the expense of insurance policy premiums and out-of-pocket prices, but only when enlisting through Attach for Health And Wellness Colorado. If you experience specific changes in your life,, you are eligible for a 60-day time period where you can register in a specific strategy, also if it is outside of the annual open enrollment period of Nov.

The 2-Minute Rule for Hsmb Advisory Llc

- Link for Health Colorado has a full checklist of these Qualifying Life Events. Reliant children who are under age 26 are eligible to be consisted of as relative under a parent's coverage.

It might seem straightforward yet comprehending insurance coverage types can likewise be perplexing. Much of this confusion originates from the insurance policy industry's ongoing objective to develop tailored coverage for insurance holders. In making versatile plans, there are a range to select fromand all of those insurance coverage kinds can make it hard to recognize what a particular plan is and does.Getting The Hsmb Advisory Llc To Work

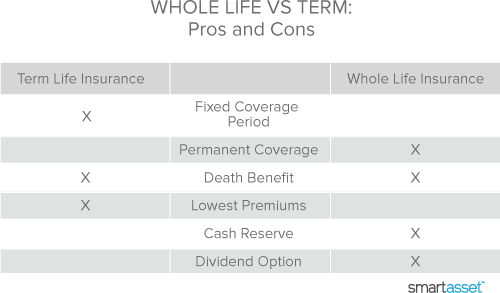

The most effective place to start is to speak about the distinction between both types of fundamental life insurance policy: term life insurance and irreversible life insurance go to these guys policy. Term life insurance coverage is life insurance policy that is just active for a while duration. If you die throughout this period, the person or individuals you have actually called as beneficiaries might get the money payout of the plan.

Nevertheless, numerous term life insurance coverage plans let you transform them to an entire life insurance policy plan, so you do not lose protection. Typically, term life insurance policy policy premium repayments (what you pay each month or year into your plan) are not secured in at the time of purchase, so every five or ten years you own the plan, your premiums could increase.

They likewise have a tendency to be less costly general than whole life, unless you buy an entire life insurance policy policy when you're young. There are additionally a few variants on term life insurance policy. One, called group term life insurance policy, is usual among insurance alternatives you may have access to through your employer.The Hsmb Advisory Llc Ideas

One more variation that you may have access to through your company is supplemental life insurance policy., or burial insuranceadditional coverage that could aid your household in situation something unforeseen occurs to you.

Long-term life insurance merely refers to any type of life insurance coverage plan that does not expire.

Report this page